Free account reconciliation template

Simplify your account reconciliation process

Reconciling your general ledger accounts doesn’t have to be complex or time-consuming. Our free, Excel-based Account Reconciliation Template gives you a ready-to-use framework to:

- Compare internal records with external statements

- Quickly identify and resolve discrepancies

- Maintain accurate, audit-ready financial documentation

- Standardize your reconciliation process across accounts

- Save time during your month-end or year-end close

Whether you're reconciling balance sheet accounts, vendor statements, or intercompany transactions, this template helps you stay organized and in control.

What’s inside the template?

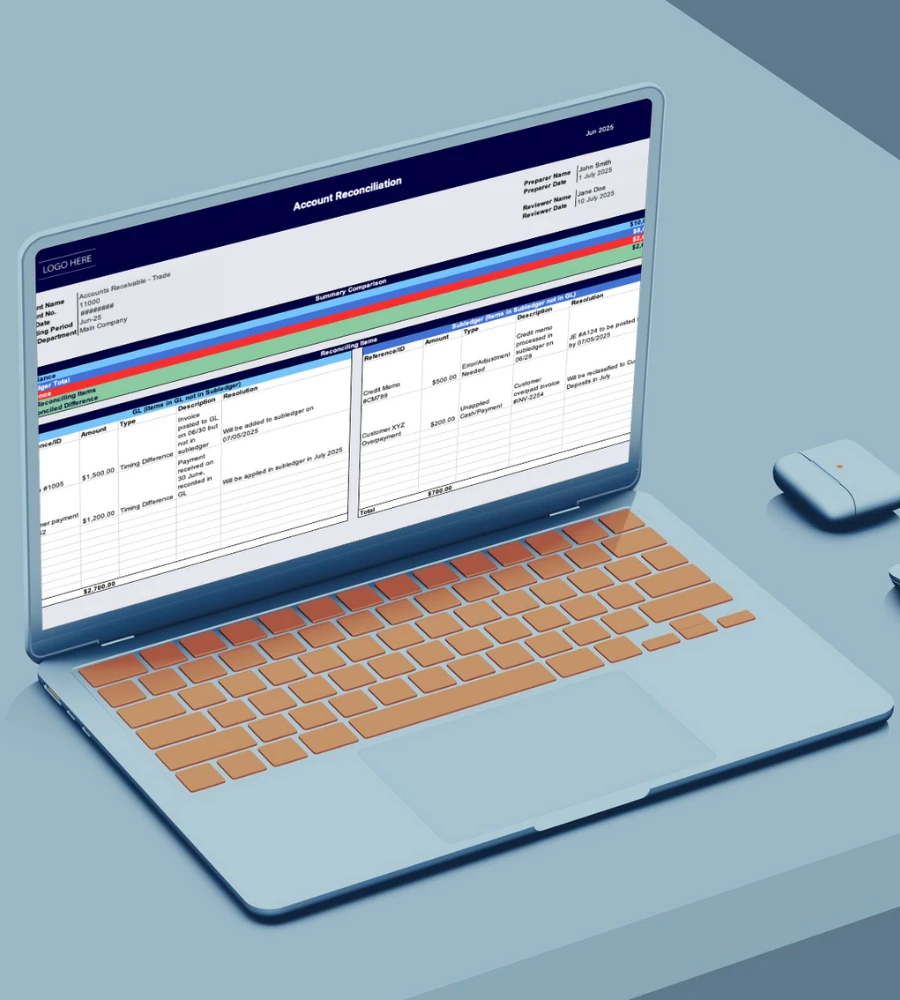

This free, easy-to-use Excel spreadsheet is built to simplify and standardize your reconciliation workflow. It includes:

- A built-in summary table that compares GL balances to subledger totals, automatically highlighting any discrepancies or unreconciled differences for faster resolution.

- Dual tables for reconciling items that separate GL-only and Subledger-only transactions, with space to enter reference IDs, amounts, transaction types, descriptions, and resolutions.

- Automatic calculations to total reconciling items and display unreconciled differences—so you can clearly see what’s outstanding at a glance.

- Customizable fields that allow you to tailor the template to your specific accounts, periods, and internal workflows.

With this free account reconciliation template, you can reduce manual errors, improve reporting accuracy, and streamline your entire reconciliation process—month after month.

Download your free account reconciliation template

Frequently asked questions

What is account reconciliation?

Account reconciliation is the process of comparing a company’s internal financial records—such as general ledger accounts—with external documents like bank statements, invoices, or supplier records. During this process, transactions may need to be reclassified to their proper accounts, such as moving deferred revenue to actual revenue on the income statement once goods or services have been provided. The goal is to ensure that all transactions are accurate, complete, and properly recorded. Account reconciliation helps identify discrepancies, prevent fraud, and maintain financial integrity.

Why is account reconciliation important?

Account reconciliation is a critical part of maintaining accurate and trustworthy financial records. Accurate reconciliations are essential for reliable financial results, ensuring that your internal records—such as general ledger balances—match external documents like bank statements, vendor invoices, or customer payments. This process helps you:

- Detect and correct errors or omissions

- Prevent fraud and unauthorized transactions

- Maintain compliance with accounting standards and audit requirements

- Support accurate financial reporting and decision-making

- Keep your books clean and ready for audits

Regular account reconciliation strengthens financial integrity, reduces risk, and builds confidence in your company’s financial health. It ensures that your business operates on a foundation of accurate data, which is essential for forecasting, budgeting, and performance analysis.

How often should you perform account reconciliation?

Account reconciliation should be performed regularly and reviewed to ensure your financial records remain accurate and up to date. Most businesses reconcile their accounts monthly, typically during the month-end close. However, accounts with high transaction volumes—such as bank accounts, accounts payable, or accounts receivable—may require weekly or even daily reconciliation to catch discrepancies early.

For optimal financial control and audit readiness, it’s best to establish a consistent reconciliation schedule based on the account type, transaction volume, and your business needs.

Why use an account reconciliation template?

An account reconciliation template helps streamline the reconciliation process by providing a structured format to input balances, compare records, and track discrepancies. It reduces manual errors, saves time, and ensures consistency across all reconciliations. Templates are especially useful during the month-end close or when preparing for audits, as they keep documentation organized and easy to review.

Is this account reconciliation template free?

Yes, this account reconciliation template is completely free to download and use. It's available in Excel format, making it easy to customize for your organization’s needs. Whether you're reconciling bank accounts, general ledger balances, or supplier statements, this template offers a simple and effective way to stay organized.

Who is this account reconciliation template for?

This free account reconciliation template is designed for anyone responsible for maintaining accurate financial records and reconciling financial services provided by different departments. It’s especially useful for:

- Finance and accounting teams managing monthly, quarterly, or year-end close processes

- Small business owners and bookkeepers who need a simple way to reconcile accounts without expensive software

- Controllers and CFOs looking for standardized documentation to support audits and internal controls

- Internal auditors preparing account documentation for compliance and risk management reviews

- Accounts payable and receivable teams reconciling supplier and customer balances

Whether you’re reconciling general ledger accounts, bank statements, or intercompany transactions, this template provides a reliable, easy-to-use framework to improve accuracy and streamline your workflow.

Can I customize the template for my business?

Yes! This account reconciliation template is fully customizable to fit your business’s specific needs. Whether you're reconciling bank accounts, vendor balances, or general ledger entries, you can:

- Add or remove columns to match your chart of accounts

- Modify formulas to align with your reconciliation rules

- Adjust labels, time periods, or account types

- Incorporate your internal workflows or approval processes

Because it's built in Excel, the template offers the flexibility to adapt to different industries, team sizes, and financial structures—so you can streamline reconciliation your way.

.svg)