Top Payment Reconciliation Software: A Guide for 2026

Businesses constantly need help with managing transactions across multiple platforms and banks. This is where payment reconciliation software comes into play. These powerful tools are designed to streamline the process of matching and verifying financial transactions, ensuring accuracy and saving valuable time. As we look ahead to 2026, it's crucial for companies to understand the landscape of payment reconciliation solutions and how they can leverage these tools to optimize their financial operations.

Coming Up

Why Choose Automated Reconciliation?

Traditionally, the reconciliation process has been a manual, time-consuming task prone to human error. However, with the advent of automated reconciliation software, businesses can now enjoy a range of benefits, including:

- Increased accuracy: Automated systems eliminate the risk of manual data entry errors, ensuring that financial records are precise and reliable.

- Time savings: By automating the reconciliation process, businesses can save countless hours that would otherwise be spent on tedious manual tasks.

- Reduced risk: Automated reconciliation minimizes the chances of fraud and financial discrepancies, providing additional security for your business.

Key Features of Effective Payment Reconciliation Software

When evaluating payment reconciliation solutions, it's essential to look for specific features to maximize your business's benefits. Some of the most critical capabilities to consider include:

Real-Time Data Processing

The ability to process financial data in real time is a game-changer for businesses. With up-to-the-minute information at your fingertips, you can make informed decisions and quickly identify any potential issues.

Robust Security Protocols

Given the sensitive nature of financial data, your payment reconciliation software must adhere to the highest security standards. Look for solutions that offer encryption, multi-factor authentication, and regular security audits.

Customization Options

Every business has unique financial management needs. The best payment reconciliation software offers a range of customization options, allowing you to tailor the system to your specific requirements.

Seamless Integration

Your payment reconciliation software should integrate seamlessly with your existing financial tools and platforms to maximize efficiency. This ensures a smooth flow of data and minimizes the need for manual intervention.

Comparison of Top Payment Reconciliation Software Providers

As you explore the market for payment reconciliation solutions, you'll encounter a range of providers, each with their strengths and capabilities. Some of the top contenders include:

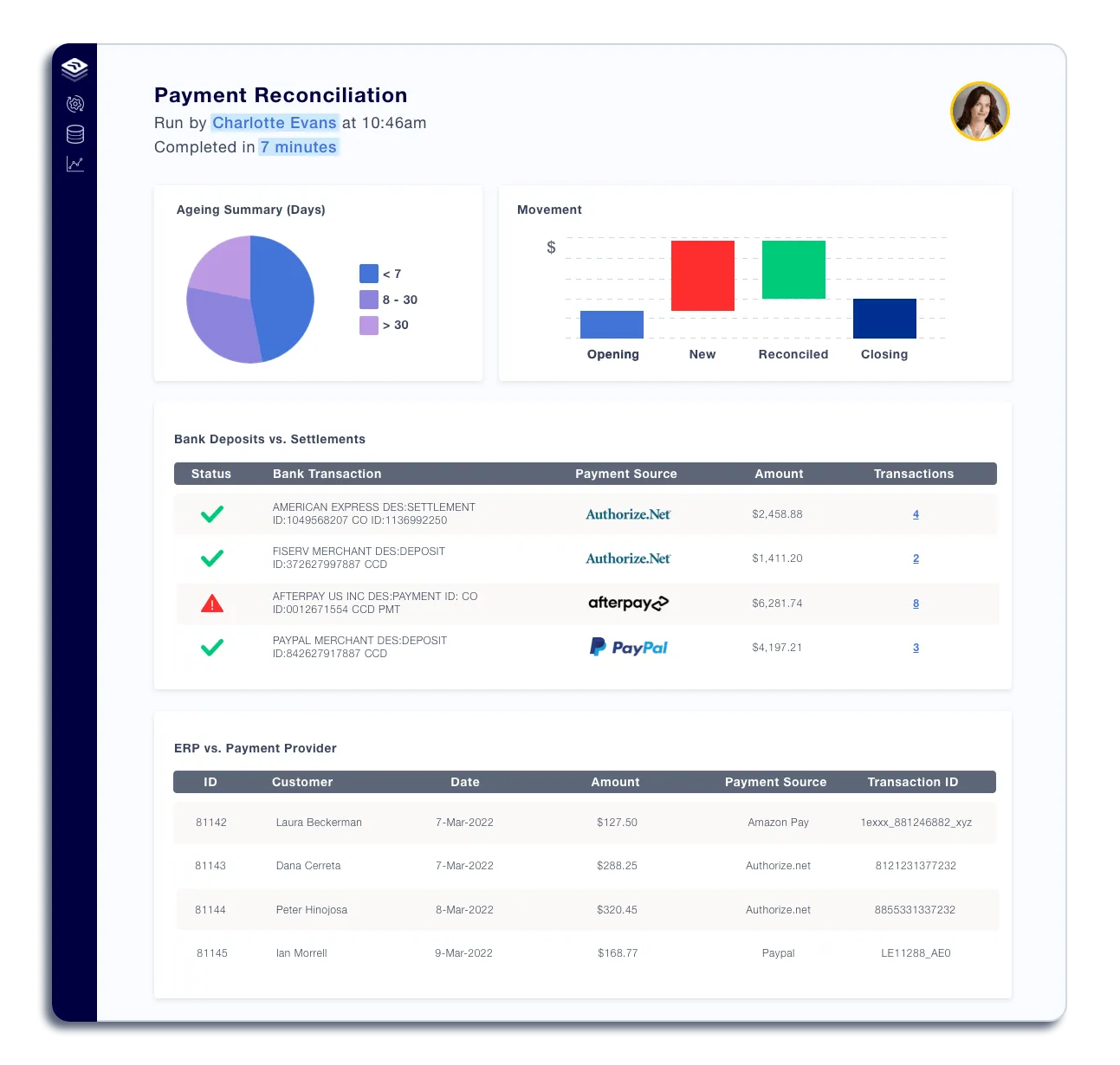

Solvexia:

Known for its user-friendly interface and powerful automation features, Solvexia is a popular choice among businesses of all sizes. The platform offers real-time data processing, customizable workflows, and robust security measures.

BlackLine:

With a focus on enterprise-level solutions, BlackLine offers a comprehensive suite of tools for financial close management, including payment reconciliation. The platform boasts advanced analytics and reporting capabilities.

ReconArt:

Designed for mid-market companies, ReconArt provides a flexible and scalable solution for payment reconciliation. The software offers a range of customization options and integrates with popular accounting platforms.

Xero:

While primarily known for its accounting software, Xero also offers robust payment reconciliation features. The platform's intuitive interface and extensive app marketplace make it a popular choice for small businesses.

Challenges in Payment Reconciliation and How Software Helps

Despite the many benefits of payment reconciliation software, businesses may still need help. Some common issues include:

Data Discrepancies

Consistencies between internal records and bank statements can lead to clarity and delays in the reconciliation process. Payment reconciliation software can help automatically identify and flag these discrepancies for further investigation.

Manual Data Entry

Some businesses may still rely on manual data entry for certain tasks, even with automated systems. This can introduce errors and slow down the reconciliation process. Look for software that minimizes manual intervention and offers features like OCR data capture.

Lack of Visibility

Without real-time data and comprehensive reporting, it can be difficult to clearly see one's financial situation. Payment reconciliation software addresses this challenge by providing up-to-date information and customizable dashboards for at-a-glance insights.

Real World Examples

To understand the practical benefits of payment reconciliation software, let's explore some real-world examples where businesses have successfully implemented these solutions.

US-Based Fintech Company

A leading US-based fintech company faced challenges with time-consuming and error-prone reconciliation processes. By implementing Solvexia, they automated their reconciliation workflows, reducing manual effort and increasing accuracy. This transformation enabled the company to reconcile transactions more efficiently, ensuring timely and accurate financial reporting.

Tala

Tala, a financial services company, streamlined its payment reconciliation process with Solvexia. The automation reduced the reconciliation time from hours to minutes, significantly improving operational efficiency. This allowed Tala to focus on strategic tasks and enhance overall financial management.

7-Eleven

Philippine Seven Corporation, the exclusive licensor of 7-Eleven in the Philippines, used Solvexia to automate e-wallet reconciliation across over 3,400 stores. The automation reduced reconciliation time from days to minutes, enhanced accuracy, and decreased fraud. Eliminating tedious manual processes also boosted staff productivity and work-life balance.

These examples demonstrate the transformative impact of adopting advanced payment reconciliation software, showcasing how automation can drive efficiency and accuracy in financial operations.

Future Trends in Payment Reconciliation Technology

As technology continues to evolve, we can expect exciting new developments in the world of payment reconciliation software. Some of the most promising trends on the horizon include:

Artificial Intelligence Integration

AI-powered tools can analyze vast amounts of financial data, identifying patterns and anomalies that might go unnoticed. As these technologies become more sophisticated, we can expect them to play an increasingly important role in payment reconciliation.

Advanced Analytics

Deriving meaningful insights from financial data is crucial for businesses looking to optimize their operations. Payment reconciliation software with advanced analytics capabilities can help companies identify trends, predict future outcomes, and make data-driven decisions.

Predictive Behavior Analysis

By analyzing historical data and user behavior, payment reconciliation software can predict future issues and suggest proactive measures to mitigate risk. This level of foresight can be invaluable for businesses looking to stay ahead of the curve.

Conclusion and Recommendations

As the financial landscape evolves, payment reconciliation software will play an increasingly vital role in helping businesses manage their transactions and maintain accurate records. When selecting a solution for your company, consider factors such as ease of use, customization options, security features, and integration capabilities.

For businesses looking for a comprehensive, user-friendly solution, Solvexia is a top choice. With its powerful automation features, real-time data processing, and robust security measures, Solvexia is well-equipped to meet the needs of businesses across various industries.

Ultimately, the right payment reconciliation software will depend on your unique business requirements. By understanding these tools' key features and benefits, you can make an informed decision and position your company for success in the years to come.

FAQ

Intelligent reconciliation solution

Intelligent rebate management solution

Intelligent financial automation solution

Intelligent Financial Automation Solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent regulatory reporting solution

Free up time and reduce errors

Recommended for you

Request a Demo

Book a 30-minute call to see how our intelligent software can give you more insights and control over your data and reporting.

Reconciliation Data Sheet

Download our data sheet to learn how to automate your reconciliations for increased accuracy, speed and control.

Regulatory Reporting Data Sheet

Download our data sheet to learn how you can prepare, validate and submit regulatory returns 10x faster with automation.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Rebate Management Data Sheet

Download our data sheet to learn how you can manage complex vendor and customer rebates and commission reporting at scale.

Top 10 Automation Challenges for CFOs

Learn how you can avoid and overcome the biggest challenges facing CFOs who want to automate.

.svg)