What is the Financial Close Process: Tips for 2026

Are you struggling to understand and improve your financial close process? Manual work and old methods can lead to missing deadlines and costly errors. Imagine upgrading your monthly financial close with streamlined and automated processes.

By embracing new techniques, you can achieve a faster close and improve accuracy. This will enable better financial reporting and improve decision making. Read this definitive guide to understand the financial close process. Discover how process improvement and automation can deliver more timely financial insights and give you a competitive advantage.

Coming Up

What is the Financial Close Process?

The financial close process refers to the recurring activities to finalize financial records and produce financial statements at the end of a month, quarter, or fiscal year. It is a critical process that ensures the accuracy and completeness of financial data. This enables compliance and allows stakeholders to make informed decisions.

The financial close process involves identifying and recording all financial transactions for the period in the accounting system. The process also involves reconciling accounts, making adjustments through journal entries for items like accruals and depreciation, reviewing account balances and generating trial balances and financial statements. Staff also carry over account balances to the next period.

The primary goal of the financial close process is to ensure that all financial activities and transactions are accurately captured, classified, and reported in compliance with accounting standards and regulations. This allows companies to produce reliable financial statements reflecting their financial position, performance, and cash flows.

Why is Financial Close Important?

A streamlined financial close process is critical for effective financial management and organizational success. Key benefits include:

- Accurate Reporting: Ensures timely, reliable financial reports, providing a solid foundation for decision-making and regulatory compliance.

- Enhanced Data Integrity: Builds trust with stakeholders and supports strategic planning by reducing errors and maintaining data consistency.

- Performance Analysis: Allows in-depth reviews of financial trends, empowering proactive adjustments to strengthen your financial position.

- Operational Efficiency: Reduces repetitive, manual tasks, allowing your team to focus on higher-value activities.

- Risk Minimization: Identifies errors and inconsistencies early, lowering financial and compliance risks.

By integrating automation, such as Solvexia’s financial automation tools, you enhance accuracy, streamline reconciliations, and meet regulatory demands effectively. Discover more ways to optimize your close process in our month-end reconciliation guide.

What are the Goals for Financial Close?

The primary goals of financial close are to ensure accuracy, efficiency, and compliance. An effective close process delivers:

- Accurate Financial Statements: Reflects your company’s financial position, supporting transparency and informed decision-making.

- Regulatory Compliance: Meets reporting requirements and minimizes risk of non-compliance penalties.

- Data Consistency: Maintains reliable records, enabling trend analysis and future planning.

- Operational Efficiency: Streamlines workflows, allowing your team to allocate time to strategic tasks.

Adopting automated solutions, like Solvexia’s financial automation, can help achieve these goals by increasing accuracy and reducing close cycle time.

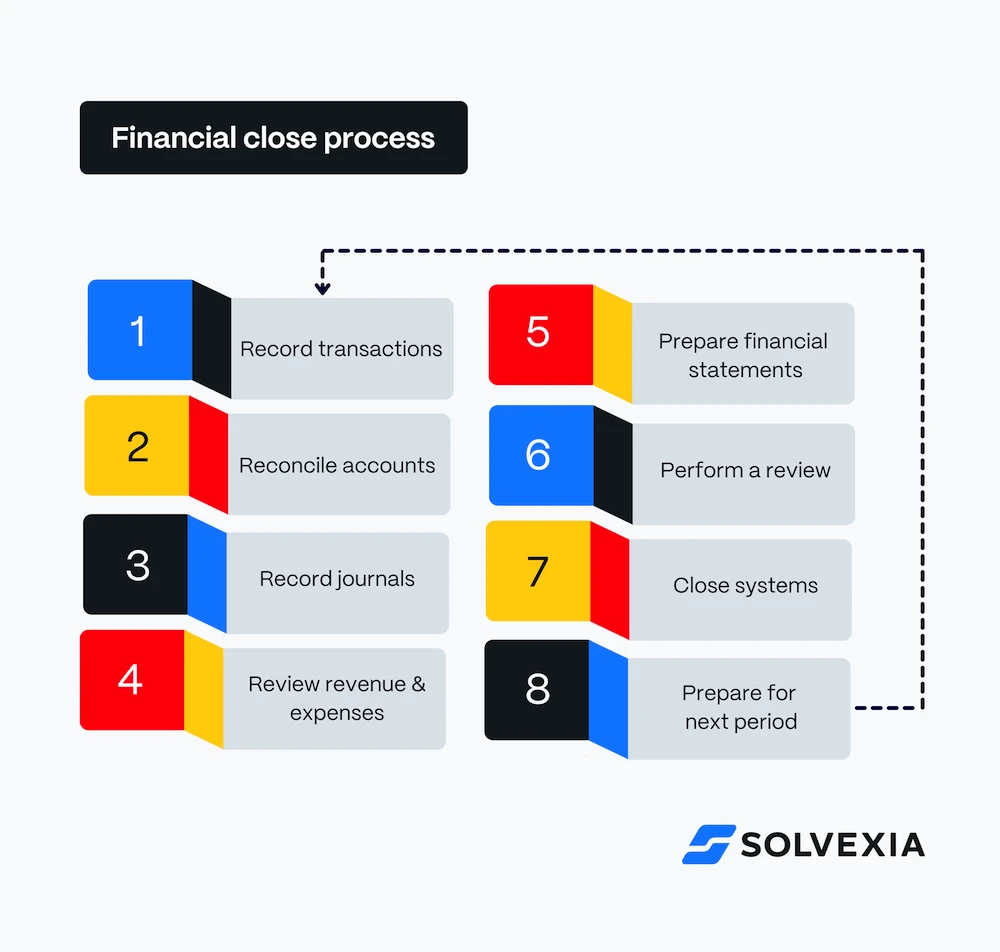

What are the Financial Close Process Steps?

The financial close process consists of several steps:

- Record Daily Transactions: Throughout the accounting period, all financial transactions, including sales, purchases, receipts, and payments, must be recorded in the accounting system as journal entries. Accurate daily transaction recording ensures that all financial activities are captured in real time, reducing the risk of missing or incorrect entries at the end of the period.

- Reconcile Accounts: Account reconciliation involves matching the recorded transactions with external statements, such as bank statements, to ensure consistency and accuracy. This step also includes reconciling sub-ledgers with the general ledger. Reconciliation helps identify and correct discrepancies, ensuring the financial records accurately reflect the company's financial position. Regular reconciliation throughout the period can help streamline the month-end and year-end close process.

- Record Monthly Journal Entries: Monthly journal entries include adjustments for accruals, deferrals, depreciation, amortization, and other necessary adjustments. During month-end close, these entries may also include corrections for errors identified during reconciliations. These entries ensure that revenues and expenses are recorded in the correct accounting period, providing a more accurate financial picture.

- Review Revenue and Expense Accounts: Reviewing revenue and expense accounts involves analyzing the income and expense transactions to ensure they are correctly recorded and categorized. This step may include comparing actual results to budgets and forecasts. This review helps identify errors or unusual transactions that must be addressed before finalizing the financial statements.

- Prepare Financial Statements: Financial statements, including the income statement, balance sheet, and cash flow statement, are prepared based on the reconciled and adjusted accounts. This step may also include preparing supporting schedules and notes for the financial statements.

- Perform a Review: A thorough review of the financial statements and underlying data is conducted to ensure accuracy and completeness. This may involve multiple levels of review by different team members or departments, such as accounting managers, controllers, and CFOs. The review process helps catch any remaining errors or inconsistencies, ensuring the final financial statements are accurate and reliable.

- Close Systems: Closing the systems involves finalizing the accounting records for the period, preventing any further changes to the financial data. This step may include locking the accounting period in the software and backing up the financial data. Closing the systems ensures the integrity of the financial data and prepares the accounting system for the next period's transactions.

- Prepare for the Next Period: This step involves setting up the accounting system for the next period, including rolling over balances, updating budgets and forecasts, and preparing for new transactions. It may also include reviewing and updating the financial close checklist and timeline for the next period. Proper preparation for the next period ensures a smooth transition and continuity in financial reporting.

What are Common Challenges in Financial Close?

The financial close process involves vast amounts of data, transaction matching, statement creation, and reporting. As firms grow, the complexity increases with more accounts to track and reconcile. Organizations face several common challenges during the financial close process, which can hinder accuracy, efficiency, and compliance.

Timeliness:

Meeting deadlines can be difficult with manual processes and disparate systems, leading to delays in financial reporting. Only 38% of companies close their books in 5-6 days. The remaining 62% attribute slower closes to growing business complexity and increased regulatory requirements.

Manual Errors:

Human errors are a significant challenge, with many organizations relying on manual processes prone to mistakes. Nearly 90% of errors related to the financial close process are undetected until after the close.

Disparate Systems:

Collecting data from various systems manually is time-consuming and increases the risk of errors. Many organizations face challenges from multiple ERP instances and integration gaps with third-party tools. This can hinder performance and accuracy, making the close process more complex and error-prone.

Poor Data Quality:

Inaccurate or incomplete data can lead to errors and delays in the financial close process. Poor data quality can stem from manual data entry, lack of standardization, or inconsistencies across different systems.

Under-Supported Teams:

A limited budget or personnel can result in a lack of resources available to complete the financial close process efficiently. This can lead to errors, missed deadlines, and a lack of control over the process. Accounting teams may struggle to handle the workload, especially during peak periods.

Remote Teams:

The shift to remote work has further complicated the financial close process, requiring robust systems to store, secure, collect, and manage financial data effectively. Collaborating and communicating efficiently with remote teams can be challenging, increasing the risk of misunderstandings and delays.

Compliance and Regulatory Requirements:

Public companies and certain industries must adhere to specific accounting standards and regulatory requirements. This may include Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Keeping up with evolving regulations and ensuring compliance can be challenging and time-consuming.

What is the Difference between Financial Close and Closing the Books?

Although often used interchangeably, "financial close" and "closing the books" refer to distinct aspects of the accounting cycle. The financial close is a comprehensive process encompassing all accounting and financial activities at the end of a month, quarter, or year.

On the other hand, closing the books is a specific step within the financial close process that focuses on resetting temporary account balances to zero and transferring balances to permanent accounts, such as retained earnings. This step prepares the accounting system for the next period and is usually the responsibility of the accounting team.

What are the Best Practices for Financial Close?

By implementing best practices and leveraging technology, organizations can streamline their financial close process, reduce errors, and improve efficiency. Here are some key best practices to consider:

Reconcile Accounts More Frequently

Instead of waiting until the end of the period, leading companies are moving towards a continuous close by reconciling accounts daily or weekly. This approach helps identify and resolve issues earlier, preventing them from escalating and causing delays.

According to Gartner Research, reconciling accounts more frequently allows companies to address discrepancies more promptly, improving the overall efficiency of the financial close process.

Develop a Standard Operating Procedure (SOP)

Creating a standardized SOP ensures consistency and accountability and reduces errors in the financial close process. The SOP should clearly outline each task's roles, responsibilities, deadlines, and step-by-step procedures.

An Ernst & Young study found that only 38% of companies have formal policies and procedures for their financial close process.

Implement Access Controls for Data

Establishing proper access controls and permissions is crucial for maintaining data integrity and preventing unauthorized changes during the financial close process. Only authorized personnel should have access to critical financial data, and any modifications should be tracked and auditable.

PwC Advisory warns that a lack of access controls can lead to data integrity issues, unauthorized changes, and compliance risks.

Leverage Automation and Technology

Implementing automation tools and cloud-based solutions can significantly streamline repetitive tasks, reduce manual errors, and improve efficiency during the financial close process. According to a Blackline study, financial process automation can drive an over 80% improvement in productivity and achieve up to 2x faster financial close.

Automation can help with data extraction, reconciliations, journal entries, and reporting, freeing up time for more value-added activities.

Review and Optimise the Process Regularly

Continuously reviewing and optimizing the financial close process is essential for identifying bottlenecks, inefficiencies, and areas for improvement. A Trintech survey found that only 8% of finance professionals are satisfied with their visibility into their financial close process.

By establishing a culture of continuous improvement, organizations can streamline the close process and adapt to changing business needs. Regular process reviews help identify opportunities for automation, standardization, and collaboration.

Track and Monitor Key Performance Indicators (KPIs)

Tracking and monitoring key performance indicators (KPIs) related to the financial close process can provide valuable insights into its efficiency and effectiveness. Some important KPIs to consider include close cycle time, number of manual journal entries, reconciliation aging, and the percentage of automated processes.

By measuring and analyzing these KPIs, organizations can identify areas for improvement and track progress over time.

What is in the Financial Close Checklist?

A well-structured financial close checklist helps ensure no tasks are missed in the complex closing process. Essential steps include:

- Confirm Transactions: Ensure all accounts payable (AP) bills, accounts receivable (AR) invoices, timesheets, and expense reports are submitted and approved.

- Post Closing Entries: Record all required adjustments in the general ledger, including depreciation, amortization, accruals, deferrals, and revenue recognition.

- Reconcile Accounts: Reconcile balance sheets, bank accounts, credit cards, prepaid accounts, inventory, fixed assets, and deferred revenue.

- Review Intercompany Transactions: Ensure AP and AR align across departments, especially for companies with multiple entities.

- Close Subledgers: Complete and close all subledgers, such as AR and AP, which roll up to the general ledger.

- Run Financial Reports: Generate income statements, balance sheets, and cash flow statements, and perform variance analysis to identify discrepancies.

- Tax Review and Compliance: Review tax returns and ensure financial data aligns with tax requirements before submission.

- Final Review and Sign-Off: Complete a final check of all reports, obtaining necessary approvals for accuracy.

Automating these steps with solutions like Solvexia’s financial reconciliation tools reduces errors and expedites the close, helping ensure accuracy and compliance.

How Can Automation Improve the Financial Close Process?

The financial close process is complex and requires significant time, effort, and resources. However, organizations can streamline and simplify this process by leveraging financial close automation software, increasing efficiency, accuracy, and transparency.

Automation tools can handle repetitive and time-consuming tasks such as data entry, reconciliation, journal entries, and financial reporting, allowing finance teams to focus on more strategic initiatives.

Benefits of Using Financial Automation Software

- Reduction of Errors: Manual processes are inherently prone to human errors, leading to inaccurate financial statements. By automating the financial close process, organizations can significantly reduce the risk of errors, ensuring that data is consistently and accurately processed. According to a study, automation can reduce human error by up to 90%.

- Time Savings: One of the most significant benefits of financial close automation is the reduced time required to complete the process. Automation tools can handle tasks faster than people, allowing finance teams to focus on more strategic tasks. A study found that financial process automation can drive an over 80% improvement in productivity and achieve up to 2x faster financial close.

- Enhanced Transparency and Real-Time Reporting: Automation provides real-time visibility into the financial close process, enabling stakeholders to monitor progress, identify bottlenecks, and make informed decisions based on up-to-date information. Studies have shown that automation can lead to a 47% improvement in visibility, a major boost to planning organizational change.

- Improved Compliance and Audit Trails: Financial close automation solutions ensure that all steps are documented and auditable, which helps maintain compliance with regulatory requirements and reduces fraud risk. Automation can lead to a 30% reduction in time to complete and monitor close tasks.

Introducing Solvexia

Solvexia, a no-code automation platform, offers a range of features designed to streamline the financial close process. Some of the key features include:

- Data Ingestion: Solvexia automates data ingestion from various sources, ensuring that all relevant financial data is captured accurately and efficiently. The company states, "Solvexia helps Finance teams reduce the time and effort needed to combine, reconcile, map, and analyze data by automating Finance, Tax, and Compliance processes."

- Transaction Matching: The platform automates matching transactions, such as bank and credit card reconciliations, significantly reducing the time and effort required for these tasks.

- Reporting Capabilities: Solvexia provides advanced reporting capabilities, allowing users to generate accurate financial reports quickly. The platform supports real-time data analytics and visualization, which enhances decision-making. As noted by a review.

Final Thoughts

Optimizing your financial close process is essential for accurate and timely financial reporting. You can overcome common challenges and streamline your month-end and year-end close by implementing best practices, leveraging automation software like Solvexia, and continuously reviewing and improving your processes.

To learn more about how Solvexia can help transform your financial close process, request a demo and see first hand how it can help your financial closure process.

FAQ

Intelligent reconciliation solution

Intelligent rebate management solution

Intelligent financial automation solution

Intelligent Financial Automation Solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent regulatory reporting solution

Free up time and reduce errors

Recommended for you

Request a Demo

Book a 30-minute call to see how our intelligent software can give you more insights and control over your data and reporting.

Reconciliation Data Sheet

Download our data sheet to learn how to automate your reconciliations for increased accuracy, speed and control.

Regulatory Reporting Data Sheet

Download our data sheet to learn how you can prepare, validate and submit regulatory returns 10x faster with automation.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Rebate Management Data Sheet

Download our data sheet to learn how you can manage complex vendor and customer rebates and commission reporting at scale.

Top 10 Automation Challenges for CFOs

Learn how you can avoid and overcome the biggest challenges facing CFOs who want to automate.

.svg)