Complete Guide to Bank Reconciliation

Financial errors and fraud cost businesses an alarming 5% of their annual revenue—imagine losing $50,000 for every million in revenue. Bank reconciliation serves as your financial watchdog, catching discrepancies before they impact your bottom line.

This critical process does more than match numbers. It protects your assets, ensures accurate financial reporting, and helps prevent fraud. While traditional reconciliation methods demanded hours of manual work, modern automation solutions have transformed this essential task into a streamlined, efficient process.

This comprehensive guide walks you through everything you need to know about bank reconciliation—from core concepts to automation strategies that save time and boost accuracy.

Coming Up

1. What is Bank Reconciliation?

2. Types of Bank Reconciliation

3. Bank Reconciliation Statement Explained

4. What are the Steps for Bank Reconciliation?

5. Benefits of Bank Reconciliation

6. What are the Challenges of Bank Reconciliations?

7. Why Use Bank Reconciliation Software?

What is Bank Reconciliation?

Bank reconciliation is the systematic process of comparing your company's internal financial records with your bank statements to ensure all transactions match and are accurately recorded. Think of it as a financial health check that helps catch discrepancies, errors, or potential fraud.

How Does It Work?

The process involves comparing two key documents:

- Your bank statement, showing all transactions processed by your bank

- Your company's internal financial records, typically from your accounting system

When these records don't match – and they often don't due to timing differences and pending transactions – bank reconciliation helps explain why. For example, a check you've written might show in your records but hasn't yet cleared the bank, or a customer's deposit might appear in your bank statement but hasn't been recorded in your books.

Why It Matters

Regular bank reconciliation helps businesses:

- Detect unauthorized transactions or fraud early

- Identify bank fees and errors promptly

- Maintain accurate cash flow records

- Ensure all transactions are properly recorded

With modern automation tools, companies can now perform this essential task daily or weekly instead of the traditional monthly reconciliation, providing better financial visibility and control.

Types of Bank Reconciliation

Understanding the different types of bank reconciliation is crucial for maintaining accurate financial records. Each type serves a specific purpose and helps ensure financial accuracy at different levels of your organization.

1. Internal Reconciliation

Internal reconciliation acts as your organization's financial self-check, ensuring all internal departments are in sync. It involves:

- Matching sales department records with accounting department entries

- Comparing petty cash records with expense receipts

- Verifying interdepartmental transfers and allocations

2. External Reconciliation

External reconciliation involves comparing your company’s financial records with outside sources:

- Matching your internal records with the company's bank account statements

- Comparing accounts payable records with vendor statements

- Verifying customer payments against your accounts receivable

This is the most common type of reconciliation and plays a crucial role in detecting discrepancies between your books and external financial institutions.

3. Aggregate Reconciliation

Perfect for larger organizations, aggregate reconciliation combines multiple accounts for a comprehensive financial overview:

- Consolidating various bank accounts into a single financial view

- Merging subsidiary accounts for parent company reporting

- Ensuring compliance with regulatory requirements like Sarbanes-Oxley (SOX)

This type is particularly important for larger organizations with multiple accounts or entities.

Choosing the Right Type

The type of reconciliation you need depends on your:

- Business size and complexity

- Number of bank accounts and departments

- Regulatory requirements

- Internal control needs

Most businesses use a combination of these types to maintain comprehensive financial accuracy.

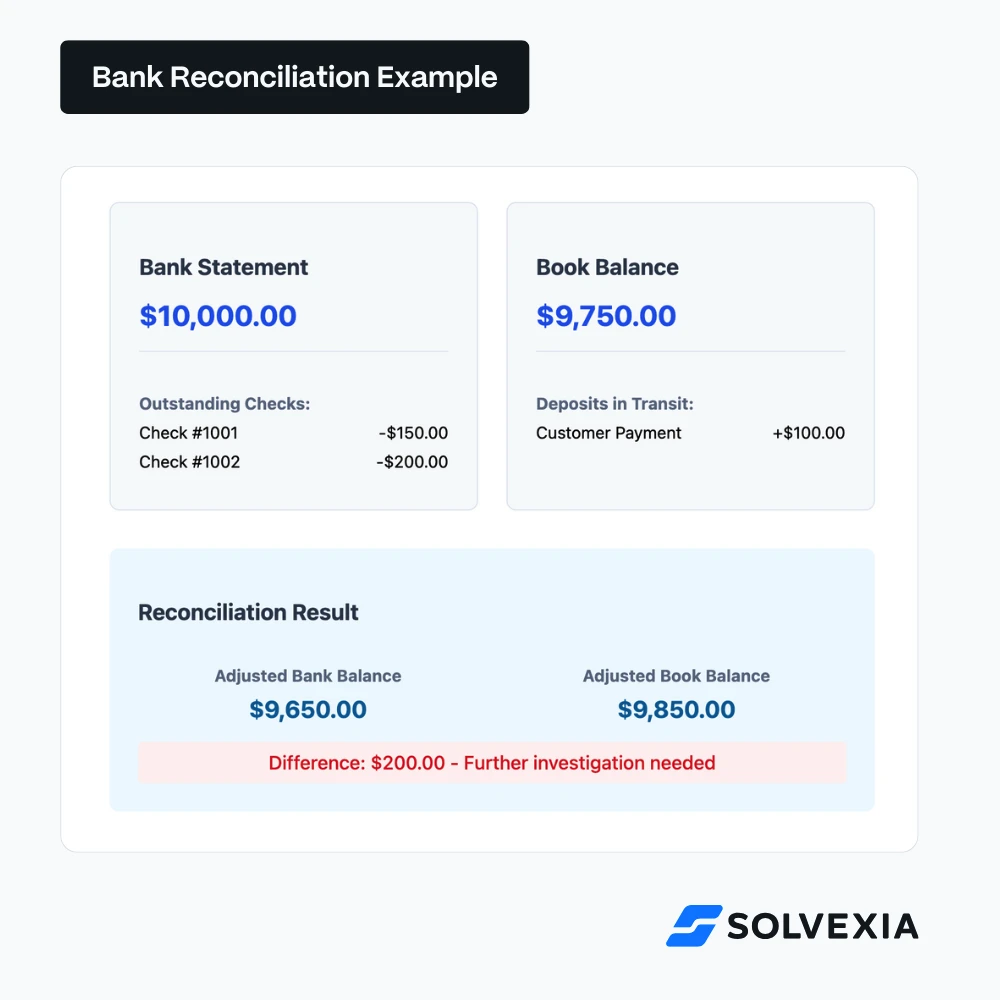

Bank Reconciliation Statement Explained

A bank reconciliation statement is a document that tracks and explains the differences between your bank statement and internal financial records. Think of it as a detailed report card of your reconciliation process, showing exactly how you got from your book balance to your bank balance.

Key Components of the Statement

1. Opening Balances

- Your company's book balance

- The bank statement balance

- Any differences between these figures

2. Timing Differences

- Deposits in transit (payments recorded in your books but not yet showing in bank)

- Outstanding checks (checks issued but not yet cashed)

3. Adjustments and Errors

- Bank fees and charges

- Interest earned

- NSF (bounced) checks

- Recording errors

4. Final Reconciled Balance

- The adjusted cash balance after all reconciling items

- Explanation of any remaining discrepancies

Why It's Important

This statement serves several critical purposes:

- Provides an audit trail for financial reviews

- Documents all adjustments made during reconciliation

- Helps track recurring reconciling items

- Serves as evidence for auditors and regulators

Pro Tip: Generate this statement immediately after completing each reconciliation while the details are fresh and all adjustments are clear.

Step-by-Step Bank Reconciliation Process

An effective bank reconciliation follows a systematic process that ensures accuracy and completeness. Here's your detailed guide to reconciling accounts, whether you're doing it manually or with automation software.

.webp)

Essential Steps

1. Gather and Review Documents

- Collect your bank statement

- Pull internal accounting records

- Review for obvious discrepancies or unusual items

- Note bank fees, interest, and other bank-initiated transactions

2. Compare Transactions

- Match deposits in your records to the bank statement

- Verify withdrawals and payments

- Mark off matching transactions

- List items that appear in one record but not the other

- Flag any discrepancies in amounts or dates

3. Identify Reconciling Items

- Note outstanding checks not yet cleared

- List deposits in transit

- Document bank fees and interest earned

- Record any NSF checks or reversed transactions

4. Make Necessary Adjustments

- Update your internal records with bank fees

- Add interest earned to your books

- Correct any errors found

- Document all adjustments made

5. Finalize and Verify

- Calculate adjusted bank balance

- Calculate adjusted book balance

- Ensure both balances match

- Prepare reconciliation statement

- Document any remaining discrepancies

Pro Tips

- Reconcile accounts frequently for easier tracking

- Use automation software to streamline the process

- Keep detailed notes of adjustments

- Save supporting documentation

- Review recurring items for patterns

Benefits of Bank Reconciliation

Regular bank reconciliation isn't just good accounting practice—it's a powerful tool that safeguards your business's financial integrity and drives smarter decision-making.

1. Proactive Fraud Protection

- Detect unauthorized transactions immediately

- Identify suspicious patterns before they escalate

- Block fraudulent activities in real-time

- Save thousands in potential losses

- Maintain customer and stakeholder trust

2. Enhanced Financial Visibility

- Access real-time cash position data

- Track payments with precision

- Monitor vendor payment status

- Verify customer payment receipts

- Make data-driven financial decisions

3. Streamlined Error Management

- Eliminate double payments

- Catch missing transactions quickly

- Fix data entry errors before they compound

- Reduce costly mistakes by up to 90%

- Maintain audit-ready records

4. Strategic Risk Management

- Prevent overdraft penalties

- Maintain required account balances

- Process payments strategically

- Protect against financial exposure

- Build stronger banking relationships

5. Optimized Cash Flow Control

- Know your exact available balance

- Time payments for maximum benefit

- Plan for future expenses confidently

- Improve working capital management

- Make strategic investment decisions

The Power of Automation

Modern reconciliation software elevates these benefits by:

- Cutting reconciliation time by 80%

- Alerting you to discrepancies instantly

- Enabling daily reconciliation

- Freeing your team for strategic work

- Providing detailed audit trails

The true value of reconciliation comes from consistency. Daily automated reconciliation catches issues when they're small and manageable, rather than letting them grow into significant problems.

Common Challenges in Bank Reconciliation (And How to Solve Them)

While bank reconciliation is essential, it comes with its share of challenges. Understanding these common issues and their solutions helps make the process smoother and more efficient.

1. Timing Differences

Uncleared Checks

Challenge: Checks written but not yet cashed create discrepancies between bank and book balances.

Solution:

- Track outstanding checks in a separate register

- Follow up on checks uncashed after 90 days

- Consider implementing electronic payments for better timing control

2. Payment Complications

Returned Checks (NSF)

Challenge: Checks deposited but returned due to insufficient funds impact your available balance.

Solution:

- Document NSF checks immediately

- Adjust your books promptly

- Consider requiring electronic payments from customers with NSF history

Voided Checks

Challenge: Voided checks can lead to double payments if not properly tracked.

Solution:

- Maintain a void check register

- Document reason for voiding

- Update both bank and internal records

- Verify replacement checks are properly recorded

3. Bank-Initiated Items

Service Fees

Challenge: Bank fees often appear on statements without prior notification.

Solution:

- Review bank fee schedules regularly

- Budget for routine service charges

- Record fees in your books monthly

Interest Income

Challenge: Interest earned may not be recorded in internal books.

Solution:

- Set up monthly reminders to record interest

- Use automation to capture recurring interest entries

- Reconcile interest earnings quarterly

4. Best Practices for Managing Challenges

- Implement regular reconciliation schedules

- Use automation software to flag discrepancies

- Maintain detailed documentation

- Establish clear follow-up procedures

- Train staff on common reconciliation issues

Why Use Bank Reconciliation Software?

Picture this: Thousands of monthly transactions, each needing to be matched between your bank statement and internal records. For a human, this means hours of tedious work. For software, it's just minutes.

The Power of Automation

Bank reconciliation software transforms this time-consuming process by:

- Matching transactions automatically in seconds

- Flagging discrepancies instantly

- Processing unlimited transactions without fatigue

- Working 24/7 without breaks or errors

- Ensuring scalability as business transactions grow

Real Business Impact

Time and Cost Savings

- Reduce reconciliation time by up to 90%

- Eliminate manual data entry

- Free up staff for strategic tasks

- Cut operational costs

Enhanced Accuracy

- Remove human error risk

- Detect patterns and anomalies

- Identify fraud attempts quickly

- Maintain consistent processes

Key Features to Look For

- Real-time transaction matching

- Automated exception reporting

- Customizable rules engine

- Clear audit trails

- Integration capabilities with existing systems

- User-friendly dashboard

By investing in reconciliation software, you're not just buying a tool—you're investing in your team's productivity and your company's financial accuracy.

Wrap Up

From bank reconciliations to balance sheet reconciliations, the various types of financial reconciliations are not going anywhere any time soon. In fact, with more data and transactions occurring digitally, the need for accurate and real-time updates is even more necessary.

To overcome bank reconciliation problems, you can utilize automation solutions to carry out the process for your business any time you wish to run it.

To see how Solvexia can help your company perform its bank reconciliations, request a demo!

FAQ

Intelligent reconciliation solution

Intelligent rebate management solution

Intelligent financial automation solution

Intelligent Financial Automation Solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent regulatory reporting solution

Free up time and reduce errors

Recommended for you

Request a Demo

Book a 30-minute call to see how our intelligent software can give you more insights and control over your data and reporting.

Reconciliation Data Sheet

Download our data sheet to learn how to automate your reconciliations for increased accuracy, speed and control.

Regulatory Reporting Data Sheet

Download our data sheet to learn how you can prepare, validate and submit regulatory returns 10x faster with automation.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Rebate Management Data Sheet

Download our data sheet to learn how you can manage complex vendor and customer rebates and commission reporting at scale.

Top 10 Automation Challenges for CFOs

Learn how you can avoid and overcome the biggest challenges facing CFOs who want to automate.

.svg)