Monthly Bank Reconciliation: Experts Guide & Best Practices

Businesses have to keep an eye on their bank account. With money flowing in and out, it’s imperative that documentation and controls are correct, especially because it ends up informing the financial statements, and thus, big decisions.

By performing monthly bank reconciliation, stakeholders and business leaders can rest assured in knowing that their finances are in order.

We’re going to look at what the bank reconciliation statement format is, as well as share ways in which finance automation software can help to streamline the process with accuracy.

Coming Up

What is a Monthly Bank Reconciliation Statement?

What are the Benefits of a Monthly Bank Reconciliation?

How to do a Monthly Bank Reconciliation?

How to Adjust Discrepancies for Monthly Bank Reconciliations?

What are Challenges of a Monthly Bank Reconciliation?

How Automation Solves Monthly Bank Reconciliations?

How Often Should You Do a Monthly Bank Reconciliation?

What is a Monthly Bank Reconciliation Statement?

A monthly bank reconciliation statement compares the company’s accounting records with its bank account balance to make sure that they match. If there are discrepancies, the bank reconciliation statement will explain the differences between the two or remedy any mistakes that may have occurred.

A bank reconciliation statement can be created at set intervals of time, including quarterly, monthly, weekly, or even daily. It’s typical for most businesses to conduct bank reconciliations at least monthly as part of the month-end close process.

What are the Benefits of a Monthly Bank Reconciliation?

The need to have accurate financial statements is big enough to necessitate monthly bank reconciliation. But, that is not the only benefit that executing the process will result in.

Along with clear and correct information to make informed business decisions, monthly bank reconciliation also enables:

1. Fraud Detection

Theft is an undesirable risk of running a business, but it’s all too real. The ability to spot theft and/or suspicious activity can help to prevent large negative consequences in the short and long-term.

2. Error Correction

Mistakes happen. Fixing mistakes as soon as possible is imperative, and that’s what bank reconciliation enables. At the same time, using a finance automations software helps prevent mistakes from happening in the first place by reducing errors up to 98%.

3. Clarity on Fees

Sometimes, banks charge fees. In some cases, they are valid, and in others, they may be erroneously duplicated. Monthly bank reconciliation makes this easy to rectify.

How to do a Monthly Bank Reconciliation?

While businesses can have their own nuanced process and people involved in their monthly bank reconciliation, the steps tend to follow this workflow:

1. Collect Documents

Before you can compare anything, you have to have the data and documentation in hand to compare. So, you begin by collecting documentation, including the bank statement itself, along with your internal account ledgers.

2. Review Opening Balance

Take a look at the opening balance on both the bank account statement and your accounting records. Even if you do conduct bank reconciliation frequently, don’t overlook this step. It’s the starting point of how your transactions follow suit thereafter, so you want to make sure it’s all in agreement to start.

3. Cross-Check Transactions

This step tends to be the most time-consuming step of them all, especially if you have a high volume of transactions and utilize multiple payment processors (i.e. Worldpay, Stripe, Amazon, eBay, etc.).

At this stage, if you conduct bank reconciliation manually, you’ll have to go line-by-line to compare both sets of records to ensure they are in agreement.

However, if you have finance automation software running your reconciliations for you, what could take you days or weeks can now be processed in just minutes with total accuracy and full audit trails.

4. Adjust Bank Statement

If you find anything within your records that aren’t reflected in the bank statement, you’ll want to add in these items. Or, if you are using finance automation software, you’ll be flagged for discrepancies so that you can take the necessary action to fix it.

5. Update the Cash Account

In the same vein, if anything isn’t reflected in your cash account that’s on the bank statement, such as accrued interest or bank fees for example, you can edit your cash account to be in accordance.

6. Review and Approve Closing Balance

Once everything has been reviewed, it’s time to make sure that your final closing balance on your bank statement and internal account match up with one another. This will then signify the starting point for next month’s reconciliation process.

How to Adjust Discrepancies for Monthly Bank Reconciliations?

In some circumstances, you may have to adjust your bank statement and books to match up with one another.

The two most common reasons for having to do so include:

1. Interest Earned

Since interest is automatically added into your bank account after a designated period of time, your company’s cash should reflect the same additional amount.

However, it’s not going to automatically be added into your internal records. It will require that you adjust your ledger to include interest earned.

2. Bank Fees

In the same token, bank fees can be charged automatically by a bank for maintenance and be withdrawn from your account. A journal entry should also be added to your own books to reflect this amount.

3. Error Prone

Manual processes, especially when bank statements are involved, can be incredibly error-prone. Automation solutions resolve this risk because all your data is connected between systems and is set up with data and cleansing rules. Real-time reporting increases processing speed and prevents mistakes.

What are Challenges of a Monthly Bank Reconciliation?

The aforementioned adjustments are only two examples of actions you may need to take during a monthly bank reconciliation process. Along with these efforts, there are additional (and explainable) challenges that come along with bank reconciliation, including:

1. Cash-in-Transit

Cash deposits don’t tend to hit your bank account as soon as you make them as they take some time to process. So, it could be the case that you show a deposit in your internal ledger, but it hasn’t appeared on the bank statement yet.

2. Entry Mistakes

Despite attention to detail, data entry mistakes are inevitable. Perhaps a team member skipped a line item or mis-typed a number when entering transactions. This could throw off your reconciliation and take time to pinpoint. Account automation software removes this challenge by automating data entry.

3. Fraud

Fraudulent activity can also affect reconciliation. But, the action of reconciliation in itself makes it easier to catch theft and embezzlement early on.

How Automation Solves Monthly Bank Reconciliations?

Automation software is designed to manage critical finance functions so that your team doesn’t have to be bogged down with repetitive and meticulous work.

Finance automation software centralizes all your data, connects your most important systems, and performs transaction matching across documentation and systems for you. This ends up saving you so much time, money, mistakes, and even employees’ feelings of dissatisfaction.

Beyond just the time savings, automation software can also boost your employees’ productivity levels by up to 85x, so your business can accomplish more without needing extra resources or hands on deck.

And, with finance automation software, you can maintain internal control, adhere to compliance regulations, and protect your data with top-notch bank grade security.

How Often Should You Do a Monthly Bank Reconciliation?

As the term implies, monthly bank reconciliation should take place at least once a month. If you’re running a business with a really heavy volume of transactions that uses multiple payment processors, it can behoove you to conduct bank reconciliation even more frequently.

Automation software makes even daily bank reconciliation easy to accomplish as the software runs through the data collection, transaction matching, and notification steps for you.

As a result, your team members can continue executing high-level and value-add tasks without having to dedicate countless hours to the tedious task of bank reconciliation.

Closing Thoughts

Monthly bank reconciliation is a must-complete process that shouldn’t be a drag, no matter your business’ transaction volume. Since it is such a valuable process that should be standardized and error-free, many businesses utilize finance automation software to handle it so they can make informed decisions at any point in time.

With finance automation, businesses save save time, operate more efficiently, and remove the busywork from their finance department’s to-do list.

FAQ

Intelligent reconciliation solution

Intelligent rebate management solution

Intelligent financial automation solution

Intelligent Financial Automation Solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent regulatory reporting solution

Free up time and reduce errors

Recommended for you

Request a Demo

Book a 30-minute call to see how our intelligent software can give you more insights and control over your data and reporting.

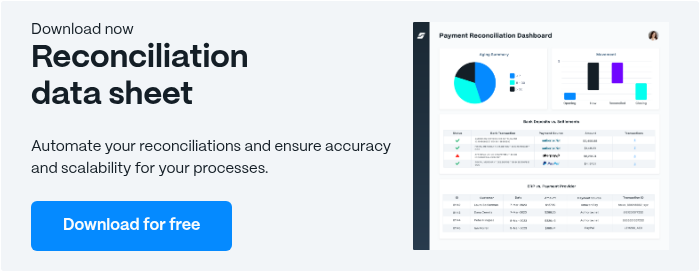

Reconciliation Data Sheet

Download our data sheet to learn how to automate your reconciliations for increased accuracy, speed and control.

Regulatory Reporting Data Sheet

Download our data sheet to learn how you can prepare, validate and submit regulatory returns 10x faster with automation.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Rebate Management Data Sheet

Download our data sheet to learn how you can manage complex vendor and customer rebates and commission reporting at scale.

Top 10 Automation Challenges for CFOs

Learn how you can avoid and overcome the biggest challenges facing CFOs who want to automate.

.svg)