Bank Reconciliation Statement: Process, Examples & Tips

A bank reconciliation statement is a financial document that compares your company's cash records with your bank statement to ensure accuracy and identify discrepancies. It's one of the most critical financial controls that protects businesses from fraud, prevents costly errors, and maintains accurate cash flow visibility.

Many businesses struggle with time-consuming manual bank reconciliation statement preparation, but modern automation can reduce reconciliation time by up to 80% while improving accuracy. This guide covers everything from basic concepts to advanced automation strategies for creating effective bank reconciliation statements.

Coming Up

What is a Bank Reconciliation Statement?

A bank reconciliation statement is a financial document that compares your company’s internal cash records with your bank’s records, specifically the official bank records, to ensure they match. Think of it as a monthly “reality check” between what you think you have in the bank and what the bank says you actually have.

The process involves taking two sets of records as part of the overall accounting process—your company’s cash book (internal records) and your bank statement—and identifying any differences between them. These differences typically arise from timing issues, bank fees, or errors that need to be corrected.

Who Uses Bank Reconciliation Statements?

- Accountants use them to maintain accurate financial records and prepare monthly closings

- Auditors rely on them to verify the accuracy of cash balances during financial audits

- Controllers and CFOs use them to monitor cash flow and detect potential fraud

- Small business owners use them to stay on top of their actual cash position

Basic Bank Reconciliation Formula:

Adjusted Bank Balance = Bank Statement Balance + Deposits in Transit - Outstanding Checks ± Bank Errors

Adjusted Book Balance = Cash Book Balance + Bank Credits - Bank Charges ± Book Errors

Simple Example:

If your cash book shows $5,000 but your bank statement shows $4,500, a bank reconciliation statement will help you identify why there’s a $500 difference—perhaps from an outstanding check you wrote that hasn’t cleared yet.

The goal is simple: both adjusted balances should match when you’re done with the bank statement reconciliation process.

Why is Bank Reconciliation Important?

Regular bank statement reconciliation isn’t just a bookkeeping formality—it’s a critical financial control that protects your business from costly mistakes and provides essential insights into your cash position. Regular bank reconciliations, performed on a monthly basis, are vital for maintaining financial accuracy and identifying discrepancies early.

Fraud Detection and Prevention

Bank reconciliation acts as your first line of defense against fraudulent activity. By comparing your records with bank statements monthly, you can quickly spot unauthorized transactions, forged checks, or electronic fund transfers you didn’t approve. Effective reconciliation processes help detect fraud and uncover cash manipulations, which could indicate accounting errors or intentional wrongdoing. The sooner you catch fraud, the better your chances of recovering stolen funds and preventing further damage.

Avoiding Overdrafts and Duplicate Charges

Without accurate reconciliation, you might think you have more money available than you actually do. This can lead to bounced checks, overdraft fees, and embarrassing situations with vendors or employees. Regular reconciliation also helps you catch duplicate charges or incorrect bank fees before they accumulate.

Ensuring Cash Flow Accuracy

Your cash flow projections are only as good as your underlying data. Bank reconciliation ensures your financial statements reflect your true cash position, enabling better business decisions about investments, expenses, and growth opportunities. Accurate and timely reconciliation directly supports your company's cash flow by preventing issues like overdrafts or missed payments. This is especially crucial for businesses operating on tight margins.

Improving Audit Readiness and Compliance

Auditors expect to see regular, well-documented bank reconciliations. Consistent reconciliation practices demonstrate strong internal controls and make the audit process smoother and less expensive. For businesses in regulated industries, proper bank statement reconciliation may be required for compliance purposes.

Peace of Mind Through Financial Control

Perhaps most importantly, regular reconciliation gives you confidence in your numbers. You’ll sleep better knowing your financial records are accurate and your cash is properly accounted for.

Step-by-Step: How to Prepare a Bank Reconciliation Statement

Creating an accurate bank reconciliation statement follows a systematic process. Here's how to do it properly:

1. Gather Bank Statements and Internal Records

Start by collecting all necessary documents:

- Your bank statement for the reconciliation period

- Company cash book or general ledger cash account

- Check register showing issued checks

- Deposit slips and receipts

- Previous month's bank reconciliation statement

Make sure you have the same time period for both your internal records and bank statement—typically month-end to month-end.

2. Compare Starting and Ending Balances

Begin by noting the ending balance on your bank statement and the ending balance in your company's cash book. These will almost never match initially, which is completely normal. The goal is to identify and explain every difference between these two figures.

3. Identify Outstanding Items

Look for transactions that appear in one record but not the other:

Deposits in Transit: Money you've recorded as deposited but doesn't appear on the bank statement yet (usually deposits made near month-end)

Outstanding Checks: Checks you've written and recorded but haven't been cashed by recipients yet

Bank Charges: Service fees, wire transfer fees, or monthly maintenance charges that appear on the bank statement but not in your books

NSF (Non-Sufficient Funds) Checks: Returned checks from customers that the bank has deducted from your account

Direct Deposits/Debits: Automatic transactions (like loan payments or customer payments) that the bank processed but you haven't recorded

4. Adjust and Reconcile Both Sides

Make calculations to adjust both balances:

Bank Side Adjustments:

- Add: Deposits in transit

- Subtract: Outstanding checks

Book Side Adjustments:

- Add: Interest earned, direct deposits, collected notes

- Subtract: Bank charges, NSF checks, automatic payments

5. Record Changes and Verify

Make journal entries for all book-side adjustments in your accounting system. The adjusted bank balance and adjusted book balance should now match exactly. If they don't, review your work to find the error.

Bank Reconciliation Statement Example

Let's walk through a real-life example for ABC Company as of March 31, 2024:

ABC Company Bank Reconciliation Statement March 31, 2024

Since both adjusted balances match at $13,330, the reconciliation is complete.

Bank Reconciliation Statement Format

Here's the standard format you should follow:

Account Reconciliation vs. Bank Reconciliation: Key Differences

While bank reconciliation and account reconciliation are both vital components of financial management, they serve different purposes and cover different scopes within your business’s financial records.

Account reconciliation is the broader process of verifying that your company’s accounting records match up with its financial statements. This can include reconciling accounts payable, accounts receivable, inventory, and other balance sheet accounts—not just cash. The goal is to ensure that every account in your general ledger accurately reflects the company’s financial position.

Bank reconciliation, on the other hand, is a specific type of account reconciliation focused solely on matching your bank statement with your company’s cash account in the accounting records. The bank reconciliation process ensures that the cash balance shown in your books aligns with the balance reported by the bank, taking into account timing differences and any bank errors.

The key difference lies in the scope: account reconciliation covers all accounts and financial statements, while bank reconciliation is limited to the bank statement and cash account. Both processes are essential for maintaining accurate financial records and preventing errors, but they require different techniques and attention to detail.

By understanding the distinction between account reconciliation and bank reconciliation, businesses can implement the right processes to ensure their financial records are both accurate and reliable—supporting better financial management and decision-making.

Common Challenges in Bank Reconciliation

Even with a well-established bank reconciliation process, businesses often encounter challenges that can complicate the task of matching their bank statement to their accounting records.

One of the most common issues is missing transactions—such as deposits or payments that haven’t been recorded in either the bank statement or the company’s financial records. Incorrect amounts, whether due to data entry errors or miscommunications, can also create discrepancies that are difficult to resolve. Unauthorized transactions, including fraudulent withdrawals or double payments, can further complicate the reconciliation process and threaten your company’s cash balance.

Bank fees, interest income, and other transactions like wire transfers or direct debits can also impact the cash balance and may not always be immediately reflected in your accounting records. Additionally, issues such as insufficient funds, overdraft fees, and non-sufficient funds (NSF) checks can cause unexpected differences between your bank statement and your books.

To overcome these challenges, it’s essential to perform bank reconciliations on a regular basis, use reliable accounting software to track all financial transactions, and maintain accurate, up-to-date financial records. By staying proactive and organized, businesses can minimize errors, quickly identify unauthorized or missing transactions, and ensure that their cash balance remains accurate and trustworthy.

Best Practices for Efficient Bank Reconciliation

Implementing the right processes and controls can transform bank reconciliation from a tedious monthly chore into a streamlined, reliable financial control. Here are the key practices that separate well-managed businesses from those constantly struggling with cash management issues.

1. Establish a Regular Reconciliation Schedule

The most successful businesses reconcile their bank accounts at consistent intervals. Monthly reconciliation is the absolute minimum, but higher-volume businesses should consider weekly or even daily reconciliation. The longer you wait between reconciliations, the more difficult it becomes to identify and resolve discrepancies. Regular bank statement reconciliation also means you'll catch errors and fraud much faster, potentially saving thousands of dollars.

Set specific dates each month (like the 5th business day after month-end) and stick to them religiously. This creates accountability and ensures reconciliation doesn't get pushed aside during busy periods.

2. Leverage Automation Where Possible

Manual reconciliation is time-consuming and error-prone. Modern businesses are increasingly turning to automated bank reconciliation solutions that can match transactions, identify discrepancies, and flag unusual items for review. Automation doesn’t eliminate the need for human oversight, but it dramatically reduces the time spent on routine matching and calculation.

Look for bank reconciliation software that can connect directly to your bank feeds, automatically import bank transactions, and provide intelligent matching suggestions. Solvexia’s bank reconciliation automation tools can reduce reconciliation time by up to 80% while improving accuracy and providing complete audit trails.

3. Maintain Comprehensive Documentation

Every adjustment, correction, and unusual item should be thoroughly documented. This includes:

- Screenshots or copies of supporting documents

- Clear explanations of adjustments made

- Names and dates of who performed the reconciliation

- Notes about recurring issues or unusual patterns

Good documentation serves multiple purposes: it helps during audits, makes it easier for other team members to review your work, and creates a historical record that can help identify trends or recurring problems.

4. Implement Strong Internal Controls

Segregation of duties is crucial for bank reconciliation integrity. The person who performs reconciliations should not be the same person who:

- Handles cash receipts or makes deposits

- Signs checks or authorizes payments

- Has sole access to online banking

Additionally, all reconciliations should be reviewed and approved by a supervisor or manager. This creates an additional layer of control and helps catch errors before they become bigger problems.

5. Create Clear Audit Trails

Every transaction should have a clear path from initiation to final recording. This means maintaining organized filing systems, using consistent reference numbers, and ensuring supporting documentation is easily accessible. Digital document management systems can be particularly helpful here, allowing you to link bank reconciliation adjustments directly to their supporting documentation.

6. Establish Materiality Thresholds

Not every small discrepancy needs extensive investigation. Establish clear thresholds for when differences require immediate attention versus when they can be noted and monitored. For example, you might investigate all differences over $100 immediately, while differences under $25 are noted but investigated only if they become recurring.

7. Regular Process Reviews

Schedule quarterly reviews of your reconciliation process to identify bottlenecks, recurring issues, or opportunities for improvement. Are certain types of transactions consistently causing problems? Are there manual steps that could be automated? Regular process evaluation ensures your reconciliation procedures stay efficient and effective as your business grows.

By following these best practices, you'll transform bank reconciliation from a necessary evil into a valuable business process that provides real insights into your cash management and financial controls.

Automating Bank Reconciliation with Software

Manual bank reconciliation processes are quickly becoming obsolete as businesses discover the power of bank statement reconciliation software. Modern platforms use artificial intelligence and machine learning to transform hours of tedious matching work into minutes of automated processing.

AI-powered reconciliation tools excel at pattern recognition, automatically matching transactions with 95%+ accuracy while flagging unusual items for human review. These systems learn from your historical data to improve over time, detecting potential fraud or errors that manual processes might miss. Platforms like Solvexia, for example, use intelligent algorithms to recognize transaction patterns and can reduce reconciliation time by up to 80% while improving accuracy.

The benefits extend beyond time savings. Automated reconciliation dramatically reduces human errors, creates comprehensive audit trails for compliance purposes, and provides real-time visibility into your cash position. As transaction volumes grow, these systems scale effortlessly while manual processes become increasingly unsustainable.

Wrapping Up

Creating accurate bank reconciliation statements protects your cash, ensures financial accuracy, and provides the foundation for sound business decisions. The key is establishing regular schedules, maintaining thorough documentation, and leveraging automation where possible.

As transaction volumes grow and regulatory requirements increase, automated bank reconciliation statement preparation becomes essential for efficient financial operations. Manual processes that once took hours can now be completed in minutes with the right tools.

Ready to transform your bank reconciliation process? Explore Solvexia's automated reconciliation solution and reduce your reconciliation time by up to 80% while improving accuracy and compliance.

FAQ

What is BRS?

BRS stands for Bank Reconciliation Statement. It's a financial document that compares your company's internal cash records with your bank statement to identify and explain any differences between the two balances.

What is the formula for reconciliation?

The basic bank reconciliation formulas are:

- Adjusted Bank Balance = Bank Statement Balance + Deposits in Transit - Outstanding Checks ± Bank Errors

- Adjusted Book Balance = Cash Book Balance + Bank Credits - Bank Charges ± Book Errors

Both adjusted balances should equal when reconciliation is complete.

How often should I reconcile?

Most businesses should reconcile monthly at minimum. High-volume businesses or those with tight cash flow should consider weekly or even daily bank statement reconciliation to catch discrepancies quickly and maintain accurate cash positions.

Can bank reconciliation be automated?

Yes, modern bank statement reconciliation software can automate most of the matching process using AI and machine learning. While human oversight is still needed for unusual items and final approval, automation can reduce reconciliation time by 80% while improving accuracy.

Intelligent reconciliation solution

Intelligent rebate management solution

Intelligent financial automation solution

Intelligent Financial Automation Solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent regulatory reporting solution

Free up time and reduce errors

Recommended for you

Request a Demo

Book a 30-minute call to see how our intelligent software can give you more insights and control over your data and reporting.

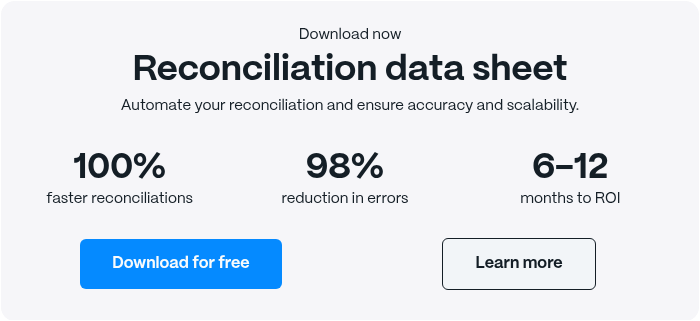

Reconciliation Data Sheet

Download our data sheet to learn how to automate your reconciliations for increased accuracy, speed and control.

Regulatory Reporting Data Sheet

Download our data sheet to learn how you can prepare, validate and submit regulatory returns 10x faster with automation.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Rebate Management Data Sheet

Download our data sheet to learn how you can manage complex vendor and customer rebates and commission reporting at scale.

Top 10 Automation Challenges for CFOs

Learn how you can avoid and overcome the biggest challenges facing CFOs who want to automate.

.svg)