Audit Risk: Experts Strategies to Managing Risk

Within any type of business, risk is inevitable. However, the more aware and prepared you are, the better you can be at minimising the chance of detrimental and costly outcomes. Audit risk is just one type of risk when it comes to business and financial statements.

Here, we’ll cover all the important aspects of audit risks, including types of audit risk, how to devise an audit risk model, and the types of automation software that can help alleviate the burden of it all.

Coming Up

1. What is Audit Risk? Audit Risk Definition

2. What are the Types of Audit Risk?

3. How to Calculate Audit Risk? Audit Risk Model

7. What Affects Audit Strategy?

8. Why Do Auditors Perform a Risk Assessment?

9. What is Audit Risk Assessment?

10. Audit Risk Assessment Procedures

11. What is Audit Risk vs Fraud Risk vs Business Risk?

13. Risk Management Strategies

14. Why Perform a Risk Assessment Matrix?

15. Why Use Automation Software for Risk Management?

16. How To Create a Risk Mitigation Plan?

17. Importance of Strategic Risk Management

What is Audit Risk? Audit Risk Definition

Investopedia defines audit risk as, “The risk that financial statements are materially incorrect, even though the audit opinion states that the financial reports are free of any material misstatements.” The risk can also exist if an auditor fails to detect material misstatements.

When an audit is carried out by a certified public accountant (CPA) or accountancy firm, then the auditor or firm carries the risk of being wrong in their auditing work. For this reason, many CPAs will hold malpractice insurance to mitigate the legal liability involved.

Audit risk can be managed and minimised with the aid of automation solutions (more on this to come shortly).

What are the Types of Audit Risk?

The purpose of an audit is to ensure that financial statements are accurately reflecting the financial status and health of any business. The act of performing an audit is a way to test the validity of financial statements.

This is highly important because investors, stakeholders, and creditors utilise financial statements to make their decisions about a given business.

There are two main types of audit risk, namely:

Material Misstatement Risk

If financial reports have incorrect information, then that is called a material misstatement. The term material is in reference to a dollar amount. Depending on the auditor’s subjective opinion, they choose the percentage difference from the truth that will be big enough to change their audit opinion.

The less internal control that a business has over their financial information and data, the higher the risk of material misstatement. With an automation solution, you can reduce the risk of human error and data inconsistencies to help lower this risk.

Detection risk

Detection risk refers to the risk that the auditor will fail to detect a material misstatement. We’ll share how this can happen further down in the post.

How to Calculate Audit Risk? Audit Risk Model

The best way to protect your business from audit risk is to understand how much risk you face.

The general audit risk model is calculated by using this equation:

Audit Risk = Inherent Risk x Control Risk x Detection Risk

What is Inherent Risk?

Inherent risk is the risk of having a material misstatement that naturally exists based on the nature of the business (along with the surrounding environment). It doesn’t matter how effective their control mechanism may or may not be, the risk exists based on the type of transactions and level of complexity the business faces.

If a business has a large amount of data and transactions, this risk grows larger. Additionally, the complexity of transactions and the amount of human judgment plays a role in inherent risk (i.e. derivative instruments).

Along with the transactions and complexity that internally exist, inherent risk is also affected by external factors. Political problems, economic environments, climate change, and the like also impact businesses. As such, auditors acknowledge all of these components when determining the amount of inherent risk involved in an audit.

What is Control Risk?

Control risk is the risk that a material misstatement will occur (inherently) and the business’ control mechanisms will not mitigate or detect the error.

An auditor determines the likelihood of a material misstatement based on their assessment of the business’ internal control mechanisms. Based on the transaction class, disclosure, or account balance, control risk may be affected. To determine control risk, the auditor must obtain knowledge about how the business collects, stores, transforms data, and curates its financial statements.

Automation software exists to aid businesses in optimising their internal control mechanisms. From being able to automate processes to run reports in real-time and provide live data, automation tools limit errors and increase transparency and oversight.

Automation software designed for finance departments doesn’t require human intervention, which eliminates bias, error, and the chance of fraud. All these aspects will lower the control risk immediately because there is maximised management and standardisation as all financial processes run their course.

What is Detection Risk?

While inherent risk and control risk place more onus on the business entity itself, detection risk comes down to the auditor. Detection risk is the risk that the auditor doesn’t detect material misstatements that do exist within the business’ financial statements.

Detection risk cannot be completely avoided because there is always the chance that the auditor will look over something that’s incorrect. For this reason, auditors can determine and potentially even modify the acceptable level of detection risk by:

- Choosing the type of audit procedure used

- Determining the extent of the audit procedure (i.e. sample sizes)

- Selecting the quality control mechanisms (review processes)

Detection risk can be increased by: a lack of understanding about the client, low competency, poor engagement management, or choosing to apply the wrong audit methodology.

To aid auditors in their process, automation solutions like Solvexia can provide audit trails. This way, an auditor can easily see how a process ran, what data was involved, and where the data was sourced.

What Affects Audit Strategy?

A driving force behind an auditor’s audit strategy is the acceptable level of detection risk.

Since inherent risk and control risk is outside of the hands of an auditor, their only way to impact the overall audit risk is to manage the detection risk aspect of the equation.

To exemplify, if a business has a high control risk (i.e. they lack internal control and are likely to have mistakes in their documentation), then the detection risk must be lowered by conducting more extensive and substantive audit procedures.

Why Do Auditors Perform a Risk Assessment?

Risk assessments help auditors to:

- Understand the business entity and surrounding environment

- Gain knowledge of the internal controls

- Identify risk using preliminary analytical procedures

- Gauge fraud risk

What is Audit Risk Assessment?

An audit risk assessment is akin to an apartment walk-through when looking to rent a new place. It allows an auditor to review the business and its processes to determine where risk is likely to exist.

An audit risk assessment should involve questions about management and the team involved in procuring financial statements, along with the likelihood of material misstatement or fraud.

Using observation and analytical procedures, an audit risk assessment is the preliminary investigative work necessary before an auditor begins their audit.

Audit Risk Assessment Procedures

The audit risk assessment includes:

- Inquiry

- Inspection

- Observation

- Analytics

What is Audit Risk vs Fraud Risk vs Business Risk?

Since audit risk involves the nature of business, it becomes easy to conflate with business risk. To avoid this, let’s summarise and define what audit risk, fraud risk, and business risk are:

- Audit Risk: Audit risk is the risk that an auditor concludes an incorrect audit opinion about your business’ financial statements. This can be because of detection risk or material misstatements.

- Business Risk: Business risks are factors that can lead to business failure or thwart a business in its endeavour to provide value to its customer. Some types of business risk include: cash flow problems, a rise in production costs, loss of customers, over trading, inadequate financing, litigations and claims, etc.

- Fraud Risk: Fraud risk is akin to an audit risk; however, it’s the risk that a financial statement has a material misstatement that goes undetected by both an auditor and management.

How to Plan a Risk Audit?

Audit risks are inevitable, and so are many types of business risks. However, there is a way to prepare for the risks involved in running a business if you are proactive and realistic with the situation at hand.

Business leaders and managers can conduct a risk audit to identify, verify, measure, document, analyse and report the range of risks in existence. Just like auditors review financial statements, a risk audit is a review of current practices and situations that can be used to manage and minimise detrimental consequences.

To plan a risk audit, you’ll need to:

- Define the situation that is being audited

- Determine the strategy for gathering information

- Create checklists and procedures to ensure that that audit is robust

- Arrange for interviews, observations, and site visits, etc.

Risk Management Strategies

Risk management strategies complement a risk audit to assign responsibilities and decide how to deal with each type of risk that your business faces.

Risk management strategy is the process of performing risk assessment, risk response, and risk monitoring. First, you are tasked with risk identification and the likelihood of the risk occurring. Then, you can prioritise which risks are worth focusing on. If the risk takes place or a plan of mitigation is enacted, then you can monitor, assess, and document the outcomes for future reference and next steps.

Types of Risk

You can generally categorise risk into these two buckets:

- Strategic risks: Decisions that affect the direction of the business (financial risk, change management risk, etc.)

- Operational risks: Decisions that affect the day-to-day operations of a business (machines breaking, data loss, etc.)

There are many types of risks that exist. Some of them include:

- Financial risk

- Regulatory risk

- Operational risk

- Systematic risk

- Unsystematic risk

- Management risk

- Legal risk

- Competition

- Social risk

- Interest rate risk

How to Manage Risk

To manage risk adequately in an organisation of any size, consider taking a top-down approach. This means that the responsibility is on leaders and managers to assess risks and communicate the strategy to the rest of the organisation. Every individual should be made aware of the expectations involved and the overall culture surrounding risk.

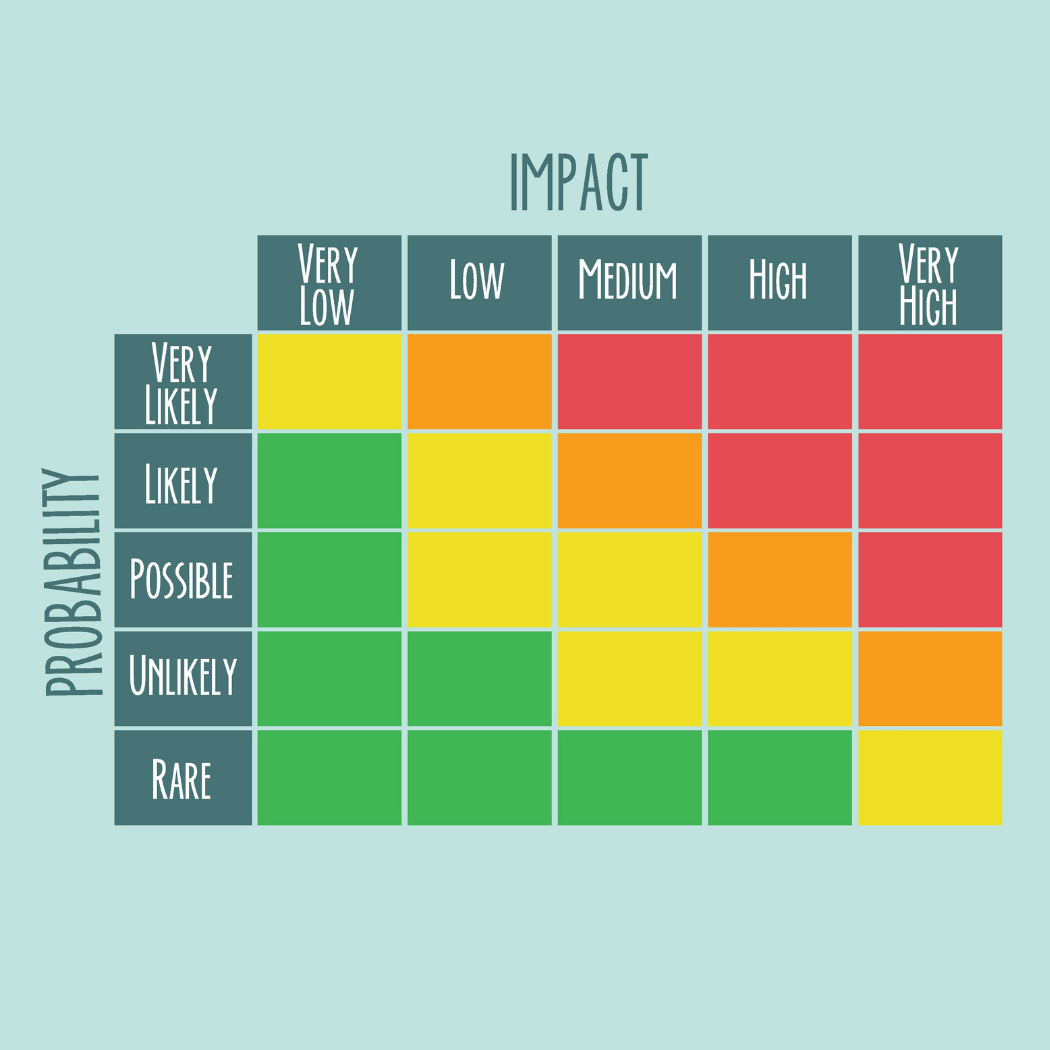

To do so, you can create a risk assessment matrix to aid in both identifying risks and developing risk management strategies for dealing with each risk.

Risk Strategy Options

The four main types of risk mitigation strategies are:

- Avoid: If you can fully control the activity that involves risk, you have the option to entirely avoid the risk-causing factor. However, you also forego the benefits of undertaking said activity.

- Reduce: Minimise the negative effects or likelihood of the risk occurring. Many organisations utilise automation solutions to help mitigate various types of risk by streamlining processes.

- Accept: If risk mitigation strategies are more costly than the potential downsides of the risk occurring, it could be in your best interest to accept the risk.

- Transfer: Alternatively, you can transfer risk to a third party (i.e. buy an insurance plan). This option comes at a defined cost.

Why Perform a Risk Assessment Matrix?

Just like auditors perform their assessment on the level of inherent risk and control risk, businesses should also manage their risks to the degrees that they can. To make it easier to visualise risk and decide a risk mitigation strategy, you can create a risk assessment matrix.

What is a Risk Assessment Matrix?

A risk assessment matrix is a visual project management tool that displays all potential risks, the expected likelihood of occurrence, and the severity of the consequence should the risk take place.

When you have a risk assessment matrix, it becomes easier to prioritise risks and determine the strategy that’s best suited to manage each one.

How to Create a Risk Assessment Matrix?

To create a risk assessment matrix, you can follow these steps:

- Identify the risks: Involve members across departments as each person brings a new perspective and deep understanding of their day-to-day processes.

- Analyse risks: Assign a probability for each event happening by performing quantitative risk analysis.

- Assess impact: You can use a 1 to 10 scale to define how much of an impact the risk would have on your business if it took place. Or, you can use a high/low rating system, and categorise the outcome in terms of technical impact versus business impact.

- Prioritise risk: Based on the trilogy above, you’ll be able to clearly see which risks are more worth paying attention to through resource allocation and mitigation strategies.

Why Use Automation Software for Risk Management?

The concept of risk is undoubtedly a big deal for a business of any size. However, it doesn’t have to be so scary despite the uncertainty.

With the aid of risk management software and automation tools, you can better assess your level of risk and even analyse how past efforts have or have not worked in your favor. With these insights, you can be empowered to make the best possible business decisions in the face of potential danger.

Key Risks for Business

Whether you’re new in business or not, you’re likely aware of some of the key risks that take place no matter what industry you’re working in. For a quick recap:

- Interest rate risk: Interest rate changes affect your cost of capital

- Cyber risks: The rise of data means the threat of data breaches and hacks looms even larger

- Compliance risk: Companies must adhere to laws and regulations, which are often changing

- Market risk: Changes in the economy and political uncertainty affect business operations on many levels

Benefits of Risk Management Software and Automation Tools

With risk management software and automation software, your business benefits in a multitude of ways, including:

- Enhanced internal control: Business leaders and managers have a well-rounded view of operations at any point in time so they can make better and more timely decisions.

- Greater transparency: Given access controls, anyone can see what’s happening with an organisation’s operations to ensure that everything is running as smoothly as planned.

- Increased security: Risk management software and automation solutions are regularly updated which will better protect your company’s sensitive data.

- Boosted shareholder value: The ability to manage risk translates into higher profits and a better overall reputation.

- Operational efficiency: Having a clear view on risks at all times with risk management software makes it simple to properly allocate resources and deal with risks.

What to Choose in Risk Management Software?

There are many risk management software options to choose from. To help you make an informed decision, consider this checklist of important attributes:

- Shareable dashboards

- Mobile-friendly

- Ability to host documentation

- Report generation

- Real-time notifications

- Event monitoring

- Bank-grade security

- Forward-thinking

How To Create a Risk Mitigation Plan?

There will be some risks which are unavoidable to your business. Instead, you’ll look for ways to perform risk mitigation. Here’s what you need to know to do so.

What is Risk Mitigation?

Risk mitigation are steps taken in an effort to reduce the harmful effects of a risk on your business. Risk mitigation is performed with the help of a team that can assess the best way to deal with a potential threat.

The risk mitigation plan should include:

- Clear directions and action items

- A timeline for when each action should be taken

- A list of responsible parties

- The resources and funding necessary to execute the plan

Risk Mitigation vs Risk Avoidance

Risk mitigation is an approach to minimise the effect of a risk. It’s the most commonly used risk strategy in business.

Risk avoidance is adjusting a plan of action to avoid the risk from even potentially occurring. While this is an ideal situation, it’s not often possible in a practical setting.

Automation and Risk Mitigation

With any type of risk strategy deployed, including risk mitigation, automation tools can be a gamechanger for your business. For starters, automating your processes will immediately reduce many types of risk, such as security risk, compliance risk, and operational risks. Since processes can be standardised and efficiently run, you can avoid pitfalls.

Businesses that utilise automation tools benefit from:

- Better communication across the organisation and between departments

- Real-time access to data and analytics to make agile decisions

- The ability to develop a risk culture and maximise transparency so that responsible parties are held accountable for their actions

- Continuous monitoring of threats and the upside of notifications so you never miss a crucial warning

Importance of Strategic Risk Management

When talking about all the types of risks and ways to deal with risk, we’d be remiss to leave out strategic risk.

What is Strategic Risk Management?

Strategic risks are those that affect business strategy. The risk could come from a failed business decision, or the risk may be an inherent part of the business and necessary to take on in order to reap rewards.

Like risk management, strategic risk management follows the same steps of risk identification, risk assessment, and risk mitigation.

Strategic Risk Assessment Process

The process of strategic risk assessment involves these steps:

- Organisational strategy: In order to know what risks are involved, you must have a strong understanding of the overall organisational strategy and objectives.

- Data collection: Collect data on how your team members and stakeholders view strategic risk. It’s a good idea to use an automation tool to collect and organise this kind of data.

- Strategic risk profile creation: A strategic risk profile can be a heat map or even just a list of potential threats and their likelihood of taking place.

- Risk profile validation: Share the profile and ensure that stakeholders and management agree these are the risks.

- Action plan development: Clearly, you don’t want to list strategic risks with no solutions or plan of action. The crucial step is to outline how you will face each strategic risk (accept, mitigate, transfer, or avoid).

- Communication and deployment: With your strategic risk management plan in place, make sure everyone is on the same page and knows what their duties involve.

How Automation Helps Strategic Risk Management?

Automation will help with strategic risk management because you can assess and monitor risks easily.

You can input your thresholds into the automation solution and rest assured that the tool will automatically notify you should anything be going in the wrong direction. The system will know this based on its analytical abilities.

It’s also possible to use automation tools to forecast and test out different paths before actually implementing them and causing any harm to the business or its customers.

Automation tools will remove the need for timely manual labor allowing your team to focus on more strategic and creative initiatives. These tools also provide you with:

- Real-time reporting and analytics

- Process mapping features

- Increased compliance

- Audit trails

- Customisable reports

- Accurate data

- Bank-grade security

Final Words

From audit risk to strategic risk management, there’s a lot to consider when it comes to operating a successful business.

There’s certainty in the uncertainty of risk, but you can minimise the uncertainty by leveraging automation software so that operations run smoothly and all data is properly stored and accessible for any endeavour or decision.

FAQ

Intelligent reconciliation solution

Intelligent rebate management solution

Intelligent financial automation solution

Intelligent Financial Automation Solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent regulatory reporting solution

Free up time and reduce errors

Recommended for you

Request a Demo

Book a 30-minute call to see how our intelligent software can give you more insights and control over your data and reporting.

Reconciliation Data Sheet

Download our data sheet to learn how to automate your reconciliations for increased accuracy, speed and control.

Regulatory Reporting Data Sheet

Download our data sheet to learn how you can prepare, validate and submit regulatory returns 10x faster with automation.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Rebate Management Data Sheet

Download our data sheet to learn how you can manage complex vendor and customer rebates and commission reporting at scale.

Top 10 Automation Challenges for CFOs

Learn how you can avoid and overcome the biggest challenges facing CFOs who want to automate.

.svg)