5 Ways How Solvexia can Reduce your Compliance Risk

All businesses face compliance risk. Compliance is adhering to rules and laws, so compliance risk is the potential adverse outcomes of failing to comply with such requirements. Compliance risk can cost a business extensive fines, and if the fault is extreme enough, it may even threaten to shut down the entire organisation.

There are many different types of compliance risk ranging from market risk, conduct risk, data security risk, quality risk and more. Depending on the scenario, compliance risk can have many different detrimental effects on a business, including legal, financial, reputational and business impacts. That’s why it’s of utmost importance to manage compliance and ensure systems are in place to mitigate the risk.

Knowing this fact, Solvexia’s human analytical automation tool can significantly help to minimise your compliance risk in several different ways. Let’s take a look at how the system will help to not only maximise time and efficiency but also to better protect your business with both internal and external policies and communication with stakeholders.

How Solvexia Reduces Compliance Risk

1. Accuracy Through Automation

Poor quality data can affect a business’ compliance. Gartner estimates that inadequate data can cost a company $9.7 million a year. At the hands of low quality or inaccurate data, companies may make bad decisions that can affect their reputation. For example, when it comes to the financial industry, a company may perform trade with suspected terrorist financiers, or laundered money unknowingly. This can cause a potentially irreversible reputational hazard, as well as cause expensive fines or even jail time at the hands of regulators.

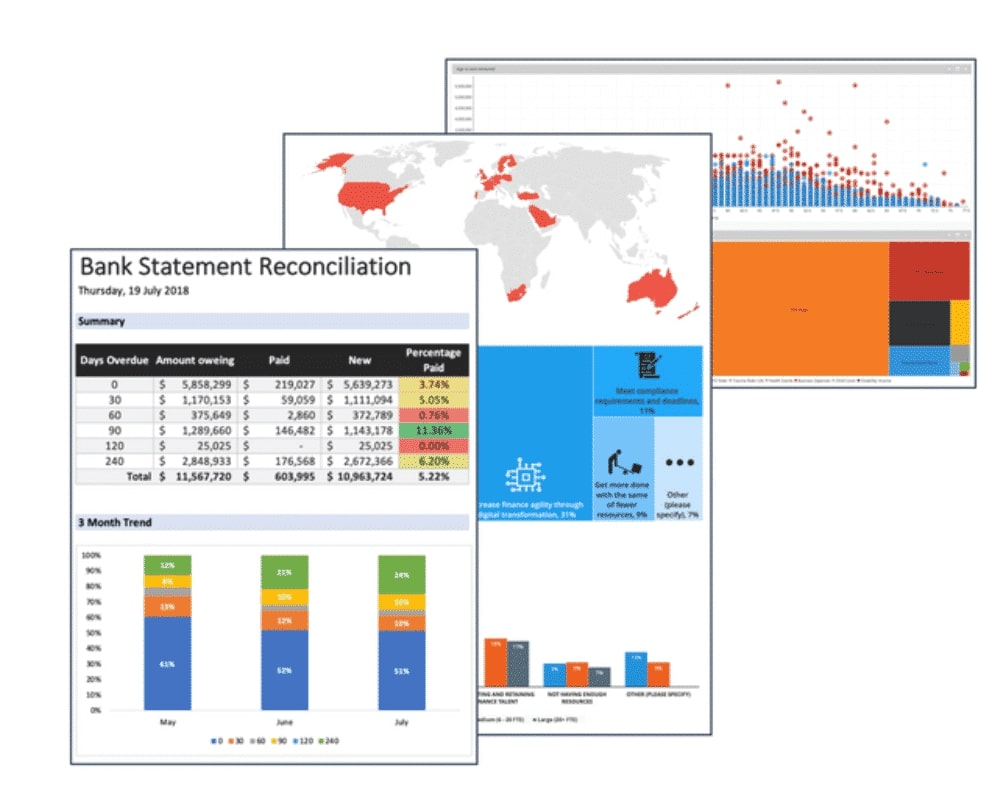

However, with automation, data from multiple systems, including legacy data, can come together and be used for more informed decision-making. The accuracy and quality of the data mean that account reconciliations and close financial reports are correctly performed, thereby reducing compliance risk. Having more accurate reports and economic forecasting models for the future can also help business leaders make decisions that will protect against the market and competitive risk.

Furthermore, the risk could even happen without knowing. If employees are instructed to migrate data from one source to another and an accidental human error occurs that changes the outcome of the information, then you have unknowingly stepped into the high-risk territory. But, with Solvexia’s automation platform, you can rest assured knowing the automation processes make sure the data cleansing, mapping and calculations are performed accurately.

2. Safe Data Storage

In a single platform, you can connect your entire enterprise. Having your data stored in one centralised location makes it easier to protect. With Solvexia, you can control employee permissions and ensure that only the right people have access to relevant information. Everything in the system is securely logged and can be reviewed.

Also, the system is backed up securely and safely using cloud technology and bank-grade architecture. Some of the biggest and most reputable financial institutions in the world rely on Solvexia to house and utilise their data. Rather than worrying about all the separate systems and locations of data, you can warehouse information in one location to better care and protect it against security breaches and data hacks.

3. Audit Trails

When you run a process with Solvexia, the system stores historical data, this means that if need be, regulators or managers can go back and track what methods occurred, as well as the information that was used to produce the outcome. There’s a version control tool, so you can quickly return to the past to track everything.

If a process has run, then the data is locked so nothing can be altered and regulators can audit the system knowing that everything is untampered. The design of Solvexia's system provides companies with peace of mind, knowing that they can quickly respond to auditors and regulators at a moment’s notice with live and transparent information about their processes.

4. Reports for Regulators

Many companies assign the task of report creation to a specific individual or department. However, if that person is sick, on leave or vacation, then you could run into trouble when a report is needed promptly. Solvexia's system automates the reporting process so that you can schedule in advance processes to occur and thereby know that they will never be forgotten. That means that you’ll never miss a deadline and if a regulator or external stakeholder asks for information, you have an easy way to deliver what they need.

The reporting structure is modern and consistent, plus easy to read and digest. You can also set the system to share reports and analysis dashboard with the parties that need to receive the information. Whether the list includes regulators or other department heads, communication is transparent so that bottlenecks and data silos will never inhibit business practices.

5. Knowledge Transfer

When it comes to all business departments, especially financial teams, there is often a high need for skilled and trained individuals, to perform high-value tasks. But, what happens when they are unavailable?

Solvexia's system makes it so that you will never miss a procedure or a process because everything is automated and outlined. The process exists in the system and can be easily accessed, managed or edited with the click of a button.

For example, say that member of your finance team is responsible for running a weekly CFO summary of financial data. The CFO relies on having this data to assess business health and make crucial decisions. If said person is out of office, anyone with permissions can open Solvexia, select the “Weekly CFO Summary” process from the sidebar of outlined and designed methods and see all the steps described on the bottom of the screen. Then, they can run the process to receive the necessary report, which (if programmed) will automatically be sent to the CFO.

Wrap Up

Compliance risk exists in all businesses and across all industries. Some companies may prioritise mitigating compliance risk to the degree that they will hire a compliance officer or even an entire team to ensure that procedures are properly designed and cared for. Depending on the type of business you run, one kind of risk may be more likely to occur than another, but Solvexia can help mitigate risks regardless of your situation and become a compliances officers most significant armoury in the fight against the threat.

Solvexia can help a business save time with day-to-day operations and timely reports and analytics. Automation software provides more value than merely completing repetitive tasks. It also merges and manipulates intensive data to provide useful insights for better decision-making. When a business can forecast the future more accurately and communicate between departments with informative data, they can lower their compliance risk and better protect themselves from market risk.

FAQ

Intelligent reconciliation solution

Intelligent rebate management solution

Intelligent financial automation solution

Intelligent Financial Automation Solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent financial automation solution

Intelligent regulatory reporting solution

Free up time and reduce errors

Recommended for you

Request a Demo

Book a 30-minute call to see how our intelligent software can give you more insights and control over your data and reporting.

Reconciliation Data Sheet

Download our data sheet to learn how to automate your reconciliations for increased accuracy, speed and control.

Regulatory Reporting Data Sheet

Download our data sheet to learn how you can prepare, validate and submit regulatory returns 10x faster with automation.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Rebate Management Data Sheet

Download our data sheet to learn how you can manage complex vendor and customer rebates and commission reporting at scale.

Top 10 Automation Challenges for CFOs

Learn how you can avoid and overcome the biggest challenges facing CFOs who want to automate.

.svg)